The Most Effective Nations for Offshore Investment and Their Monetary Benefits

The Most Effective Nations for Offshore Investment and Their Monetary Benefits

Blog Article

The Important Guide to Offshore Investment: Kinds and Their Advantages

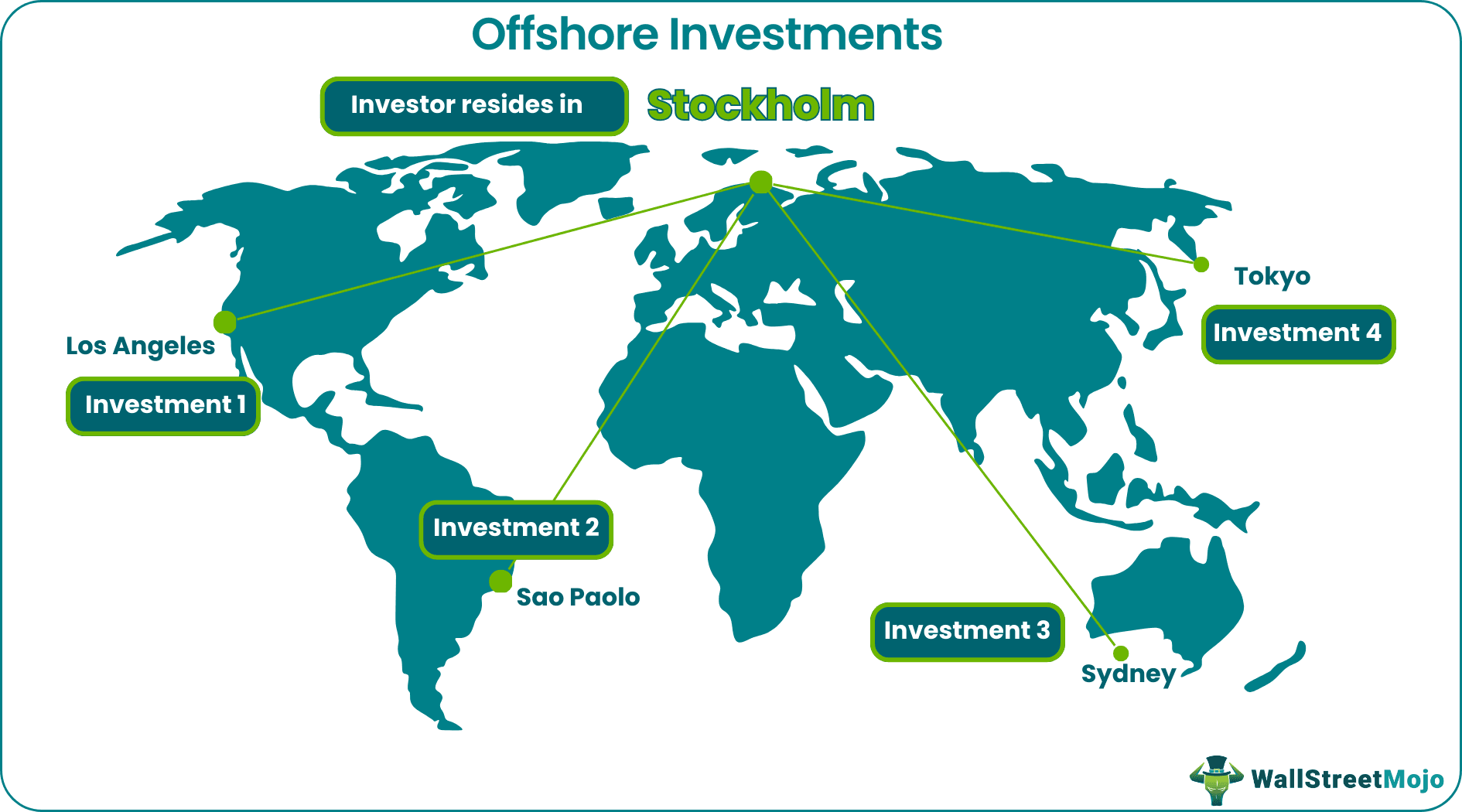

Offshore investment presents an engaging variety of options, each tailored to fulfill certain financial purposes and risk cravings. From the personal privacy afforded by overseas financial institution accounts to the security of actual estate holdings, the landscape is abundant with possibilities for both property defense and development.

Offshore Financial Institution Accounts

Offshore savings account have actually ended up being significantly prominent amongst investors seeking to diversify their monetary portfolios and protect their assets. These accounts are generally developed in territories outside the financier's home country, supplying different benefits that can boost monetary safety and security and privacy.

One main benefit of overseas checking account is property protection. By positioning funds in a foreign establishment, capitalists can secure their properties from potential political or financial instability in their home nation. Furthermore, overseas banking frequently offers greater discretion, allowing individuals to manage their wide range without bring in unwanted attention.

In addition, overseas bank accounts may supply favorable tax obligation benefits, depending upon the territory. While it is important to adhere to tax laws in one's home nation, certain offshore areas offer tax obligation incentives to foreign investors, which can bring about boosted returns on investments.

Moreover, these accounts commonly give access to international monetary markets, making it possible for financiers to check out diverse financial investment possibilities that might not be offered locally. Generally, offshore bank accounts function as a critical tool for property security, personal privacy, and financial development in a significantly globalized economic climate.

Property Investments

The allure of realty financial investments remains to expand amongst people looking for to expand their profiles and safe and secure lasting financial gains. Offshore genuine estate supplies distinct advantages, such as desirable tax routines, asset defense, and the possibility for funding gratitude. Investors can utilize homes in emerging markets or stable economies, permitting access to a wider series of investment chances.

One key advantage of offshore genuine estate is the capability to secure properties from domestic economic fluctuations or political instability. Home ownership in a foreign territory can supply a layer of safety and security and privacy, commonly appealing to high-net-worth individuals. Spending in rental residential or commercial properties can create constant income streams, boosting total economic security.

Shared Funds and ETFs

Investing in shared funds and exchange-traded funds (ETFs) offers an obtainable avenue for individuals aiming to diversify their financial investment profiles while minimizing threats connected with straight supply purchases. Both investment lorries allow investors to merge their sources, allowing them to purchase a wider variety of properties than they might take care of separately.

Shared funds are generally handled by professional fund supervisors who proactively select safeties based upon the fund's financial investment objective. Offshore Investment. This monitoring can enhance the capacity for returns, though it typically features greater costs. In comparison, ETFs are normally passively handled and track a details index, giving reduced cost ratios and other higher openness. They can be traded throughout the day on stock market, including adaptability for investors.

Both shared funds and ETFs offer tax obligation benefits in an overseas context. Mutual funds and ETFs serve as reliable tools for developing riches while navigating the intricacies of offshore investment opportunities.

Offshore Trusts

For capitalists seeking to further improve their asset defense and estate planning approaches, offshore trust funds provide a compelling option. These legal entities allow people to transfer possessions to a count on a jurisdiction outside their home nation, providing an array of benefits that can guard wealth and promote smooth succession preparation.

Among the key advantages of overseas trusts is the degree of confidentiality they use. By placing properties in an offshore trust fund, capitalists can shield their wide range from public scrutiny, thereby safeguarding their privacy. Additionally, offshore trusts can provide robust protection versus lawful cases and potential lenders, efficiently shielding properties from threats connected with litigation or bankruptcy.

Offshore trust funds additionally make it possible for adaptable estate preparation alternatives. Investors can assign certain recipients and describe the regards to asset distribution, making sure that their dreams are recognized after their passing. This can be specifically valuable for individuals with complex family characteristics his response or those wanting to offer future generations.

Furthermore, lots of offshore territories have actually established positive legal frameworks developed to support the facility and monitoring of depends on, making them an eye-catching choice for discerning investors. Generally, overseas trusts serve as a strategic tool for those wanting to enhance their financial tradition while minimizing prospective dangers.

Tax Benefits and Considerations

While several investors are attracted to overseas trust funds largely for property security and estate planning, significant tax obligation benefits and factors to consider likewise warrant interest. Offshore investment cars can use favorable tax regimens, which might lead to reduced tax obligation liabilities compared to onshore choices. Numerous territories supply tax obligation incentives such as tax obligation deferments, lower funding gains prices, or even complete tax exceptions on specific kinds of revenue.

However, it is important to browse the facility landscape of global tax obligation laws. The Foreign Account Tax Obligation Conformity Act (FATCA) and various other guidelines call for united state homeowners and residents to report international possessions, potentially leading to penalties for non-compliance. Furthermore, the Internal Earnings Solution (IRS) might impose tax obligations on overseas revenue, negating some advantages if not appropriately managed

Verdict

In final thought, offshore investment options existing diverse possibilities for property security, estate, and diversity preparation. Offshore bank accounts boost privacy, while genuine estate financial investments give stability against residential unpredictabilities.

Offshore actual pop over to this web-site estate supplies distinct benefits, such as favorable tax obligation regimes, asset defense, and the capacity for funding recognition.While numerous investors are attracted to offshore counts on largely for asset security and estate preparation, substantial tax benefits and considerations additionally warrant focus. Offshore financial investment vehicles can provide desirable tax regimes, which might result in reduced tax obligation liabilities compared to onshore choices.Capitalists should additionally take into consideration the effect of regional tax laws in the overseas jurisdiction, as these can vary considerably. Inevitably, while overseas financial investments can produce considerable tax obligation advantages, thorough due persistance and strategic preparation are paramount to optimize their potential.

Report this page